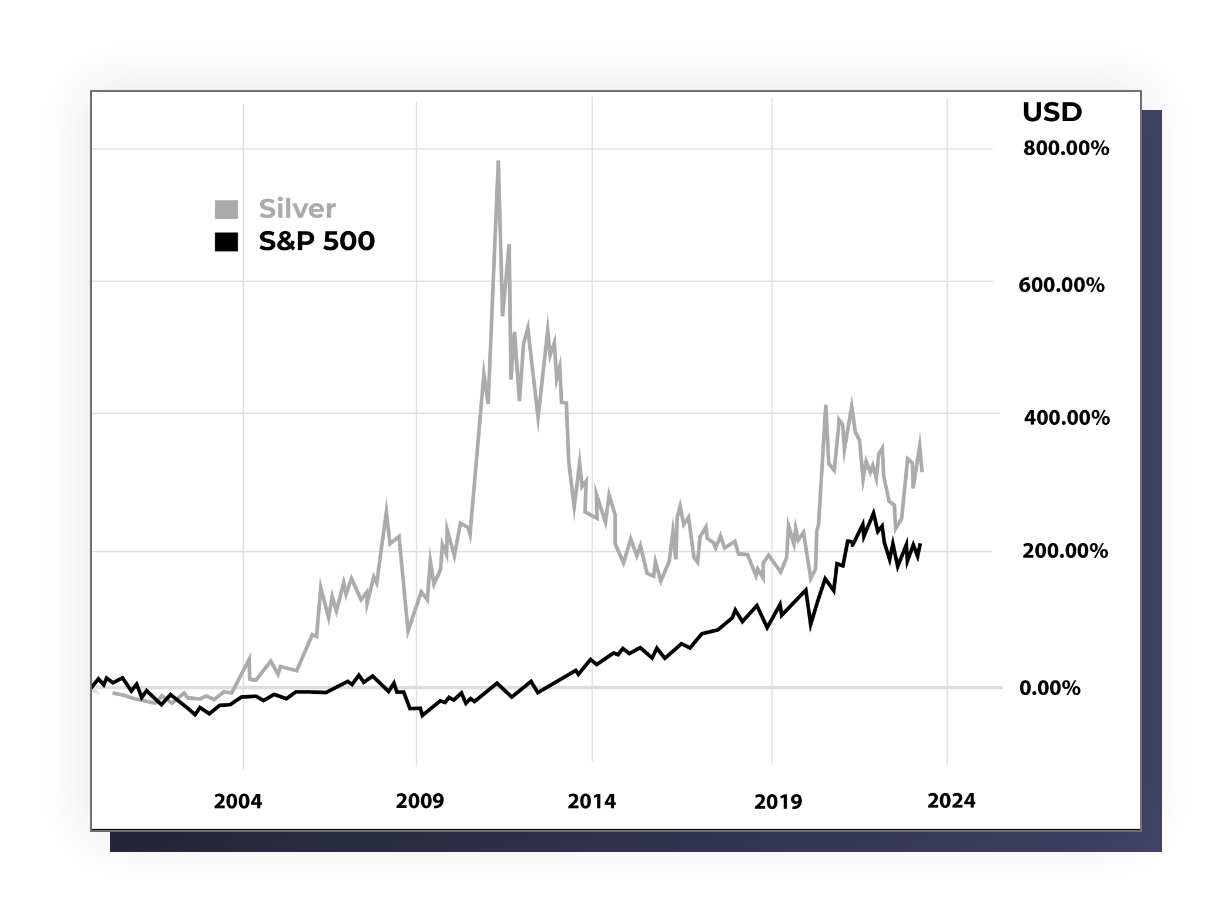

(Last 20 Years)

(Last 50 Years)

Silver - Powering Our World and Your Portfolio

No investor should skip the opportunity to own physical silver. Silver is extremely undervalued, even as its importance rapidly grows in our technologically advancing economy.

Silver boasts a rich history. However, its future is even more compelling due to its expanding industrial applications in rechargeable batteries, renewable energy, and medical technology.

Whether as a hedge against inflation, a tangible asset, or a potential source of appreciation, silver provides unique advantages for investors seeking stability, diversification, and long-term wealth preservation.

Secure Your Future: Silver's Time is Now!

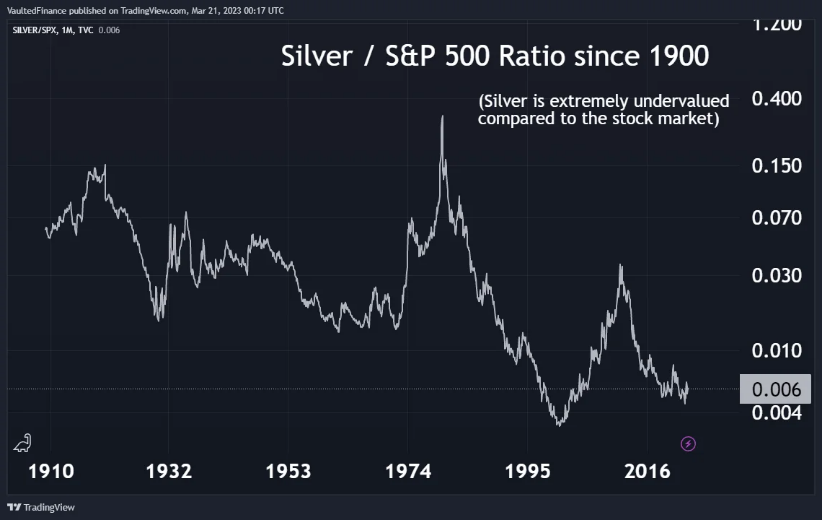

Silver is still extremely undervalued against both stocks and gold.

Physical Silver is Real Money

Silver played a pivotal role in the development of nearly all modern economies, serving as a medium of exchange for thousands of years and facilitating global trade.

This enduring value underscores silver’s relevance for preserving wealth and hedging against today’s paper currencies.

Your financial future no longer has to depend on the whims of politicians and central bankers. It is no secret that we are approaching a turning point.

With physical metals in your possession, you can fortify your financial position and navigate the evolving economic landscape with confidence.

Silver is Time-Tested

Investors trust silver to secure their savings because it represents a source of enduring value dating back thousands of years.

The Ancient Egyptians, Greeks, and Romans all recognized silver’s beauty and durability, incorporating it into jewelry, decorative objects, and coins. Silver’s antibacterial properties were valued in ancient Persia and China. The Aztecs and Incas crafted intricate silver jewelry and ornaments.

Silver is a highly versatile metal, and always will be. Its relevance is growing rapidly as new technologies rely on its conductivity, reflectivity, and antimicrobial qualities.

Silver Outperforms Gold During Bull Markets

Gold: $34.51/oz to $875.00/oz – growth of 2,435%

Silver: $1.29/oz to $1,921/oz – growth of 3,621%

Gold: $254.10/oz to $1,920.94/oz – growth of 656%

Silver: $4.05/oz to $49.83/oz – growth of 1,130%

We are in the middle of the third great bull market in precious metals. History speaks volumes, and right now it’s telling us to own silver!

Vaulted vs. The Competition:

Why We're the Best Place to Invest in Silver - Affordable, Secure, and Tangible!

Investing in physical silver offers several compelling reasons for investors.

Firstly, silver is a finite resource, and as the world’s supply continues to diminish while demand increases, the potential for price appreciation is significant. Secondly, physical silver provides tangible ownership, giving investors direct control over their investment without relying on third-party credibility. Additionally, silver serves as a hedge against inflation, as its value historically tends to rise alongside the expansion of the money supply.

Moreover, silver has diverse industrial applications, making it a valuable commodity in sectors such as technology and renewable energy. Lastly, physical silver offers portfolio diversification and acts as a store of value, providing stability and protection during economic uncertainties.

Top 10 Reasons Why Vaulted Silver is the Must-Have Investment

- THE WORLD IS RUNNING OUT OF SILVER - Silver is primarily traded in "paper" form: futures, derivatives, ETFs, etc. The silver price will need to rise precipitously to cover all paper claims as physical demand rises.

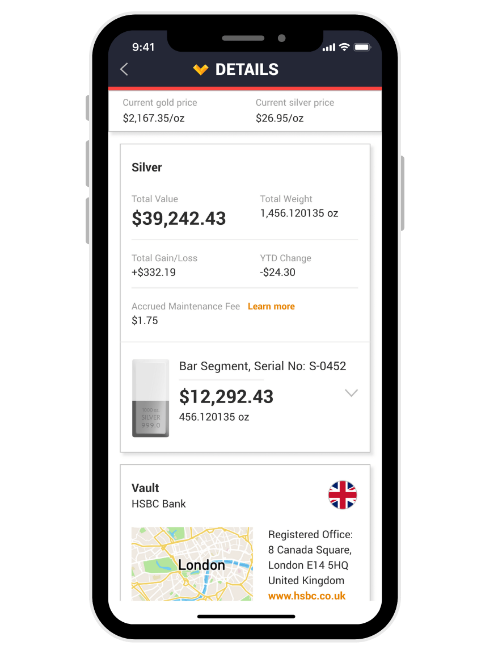

- SIMPLE, SAFE, SECURE - The Vaulted app is easy to use, robust, and secure. You get peace of mind and real-time visibility into your investment.

- NO COUNTERPARTY RISK - When you own physical silver, the value of your investment does not depend on anyone else's credibility or solvency.

- SOARING INDUSTRIAL DEMAND - Physical silver is a vital element in batteries, semiconductors, solar panels, and medical technology. The price of silver will need to adjust to rising demand.

- MOST AFFORDABLE IN THE INDUSTRY - Vaulted cut out 70% of the supply chain, which means we can offer the lowest fee structure in the industry for physical, serial-numbered silver bars.

- PROFIT POTENTIAL - The silver price is currently far below its two previous peaks: 1980 and 2011. This means HUGE upside potential.

- HISTORICALLY UNDERVALUED - The price of silver needs to double just to return to historical averages against stocks and gold.

- INFLATION PROTECTION - Silver tracks the long-term expansion of the money supply and protects investors against currency devaluation.

- LOW CORRELATION - Silver is uncorrelated with stocks, bonds, and other conventional asset classes. A silver allocation strengthens any portfolio.

- A PHYSICAL STORE OF VALUE - Vaulted silver is not just a number on a screen. It's money that actually exists in physical form.

The Best Way to Buy Physical Silver

Liquidity

Silver, like gold, is unmatched globally for its liquidity. It can be exchanged for every currency in the world, a point proven regularly by leading investment funds, central banks, and individuals. Also, gold is the most stable of the precious metals, and it has performed well both in times of deflation and inflation. By owning gold in your Vaulted account.

Frequently Asked Questions

What quality is the silver?

Where does the silver come from?